From financial institutions, brokers, wholesalers, servicers, and insurers, TRUE is here to help the mortgage industry adopt the best of what AI has to offer. Our products and solutions are engineered to help lending organizations transform their operations with the power of artificial intelligence.

At TRUE, we call this lending intelligence which helps you to better understand all the data coming into your operation, and using this information to reinvent how you deliver your products and services across the mortgage industry, while experiencing previously unimaginable levels of operational efficiency, information transparency, and risk reduction.

Exceed customer expectations with fast, flawless, smart loan decisioning.

TRUE reduces manual document review by up to 85%, boosting your underwriter productivity by 125%.

Our AI mortgage technology rapidly analyzes every data point, so loan professionals can make informed determinations easily and achieve their mortgage origination automation goals. As a result, you can reduce processing costs while accelerating your approval process and can scale to meet shifting market demands by using precise, lending-specific technology.

From Loan Officers leveraging insights about borrow needs, to operations staff tasked with processing complicated and inconsistent borrow documents, TRUE will recognize, extract, verify, and analyze every document and datapoint, ensuring that your loans are accurate, compliant, and properly funded.

Featured Role: Underwriters

With AI-powered automated mortgage underwriting, underwriters become risk management experts. Why? Their loan decisioning models and solutions can now use considerably more accurate information and they are spending more time on decisioning the facts, rather than correcting the errors.

Suggested Resources

The Continuously Improving ROI of Trusted Data

This paper considers the ROI of data in business, first generally and then in the context of the mortgage industry, to help lenders evaluate the need, effects and timing of investments that will change how your mortgage business handles data.

Loan Origination Company Improves the Client Experience

See how one of TRUE's clients, by using the power of artificial intelligence and automate document review, exceeded customer expectations with fast, flawless, smart loan decisioning, to achieve mortgage origination automation.

How Artificial Intelligence (AI) Brings Trust to Borrower Data

Our on-demand webinar includes speakers from PRMG, the STRATMOR GROUP, and TMC, as we discuss the deep-rooted challenges with borrower data, how this is affecting lender's business priorities, and how they are being overcome with AI.

Insurers have to make the right decision fast to meet increasingly short turnaround times.

TRUE speeds processing while providing incredibly accurate data.

Our automated loan document extraction software for mortgage underwriting ensures your processors have correct borrower data and loan verification information so they can make the right decisions quickly.

With TRUE, you can accelerate document identification and automate data extraction, freeing your loan decisioning team to focus on decisioning, not data correction. As TRUE is the leading provider of AI powered document processing capabilities within the mortgage insurance space, our MI solutions are proven, helping mortgage insurers have deeper confidence in the insurance they write, and prices they provide - which leads to more business, improved revenue, and reduced risk.

Featured Role: Processors

Processors are seeing an 80% - 90% improvement in document processing time and related decisioning tasks with TRUE. In the highly competitive world of mortgage insurance, time and price is the difference between won and lost business. TRUE makes the difference.

Suggested Resources

From Artificial Intelligence to Lending Intelligence

Learn about the evolution of AI in the mortgage industry, its benefits and challenges, and how it is revolutionizing lending with TRUE's technology.

AI is Now Business Critical – You Deserve to Know How It Works

Discover the potential of lending AI and how it can revolutionize business processes. Learn how MI's can improve efficiency and reduce time-to-price.

Trusting Data: How AI Boosts Confidence in Lending QC

Hear from Enact and V.I.P Mortgage and learn how AI has improved their workflows and quality control across the entire loan application process.

Whether your organization is initially funding a mortgage or providing more strategic mortgage capital capacity, the ability to completely understand, audit, and verify the value of a mortgage is critical to your funding policies and procedures.

Insights and information are critical to making the right decision, uncovering risk, and revealing opportunities. This is where AI in lending becomes increasingly important, by automatically analyzing every document, in every loan, and every data point, providing a holistic view of every mortgage your organization touches.

No sampling here, just real lending intelligence - ensuring that risk is identified, compliance is achieved, and operational efficiency is exponentially improved.

Featured Role: Quality Control

Post Close QC is being re-imagined, with systems inspecting every document, every data point, and every decision – with the recall and fidelity of a machine, surfacing previously undetectable errors and risks. With TRUE and our AI, gone are the days of sampling, and underlying risks, delivering on the promise of mortgage quality control, for every loan, document, and data point.

Suggested Resources

Transforming the Mortgage Industry with TRUE Lending Intelligence

Our white paper analyzes the capabilities of artificial intelligence and how it creates enhanced mortgage solutions for lending success.

The TRUE Story of Post-Closing QC: How AI Brings Trust to Loans

See how artificial intelligence helps ensure all documents and related loans are accurate, complete, and compliant with relevant regulations.

Trusting Data: How AI Boosts Confidence in Lending Quality Control

Hear from Enact and V.I.P Mortgage and learn how AI has improved their workflows and quality control across the entire loan application process.

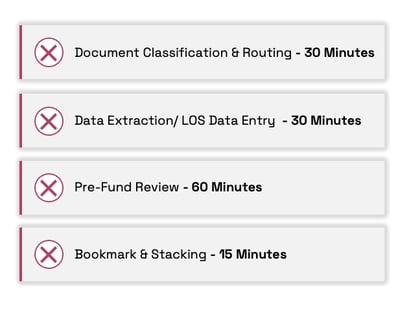

Task, likely time spent per loan BEFORE TRUE:

At an average cost of $40.00 per FTE per hour, that’s $90.00 per Loan.

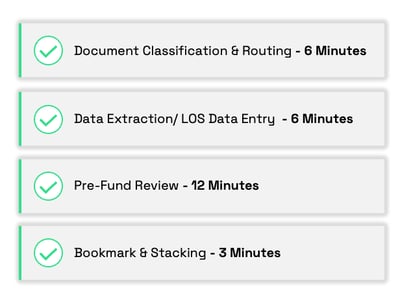

Task, likely time spent per loan AFTER TRUE:

TRUE can reduce the costs related to these tasks by at least $40 per loan, inclusive of licensing and operating costs.

Based on 66,000 loans annually, that is an annual savings of ~$2.5M.

Try Now

Try TRUE, no charge, no obligation, with our industry only, real time, online AI document manufacturing process.